Taking on debt can be a two-edged sword. It can be a great opportunity to increase short-term liquidity and may allow you to make purchases you otherwise would not have been able to make, such as a home purchase. Used carelessly, though, or in excess, it can be a dangerous enemy that can have long lasting impacts on your finances and keep you from getting ahead.

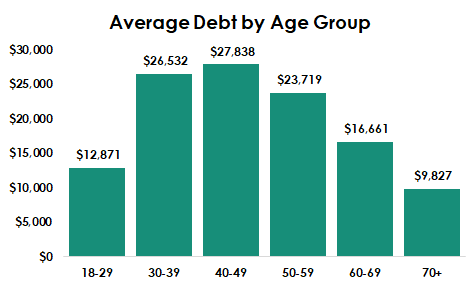

According to Debt.org, this is the average debt for Americans by age group (excluding mortgages):[1]

In contrast, investing for the future is an important step in securing your financial future, and starting early is key to maximize the power of compound interest.

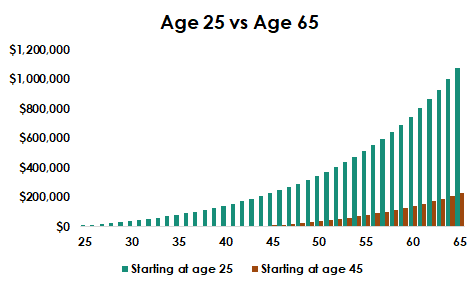

As an example, if you invested $5,000 per year into your 401(k) starting at age 25, assuming a 7% rate of return, you would have roughly $998,000 when you reached age 65.

Alternatively, if you were to start contributing the $5,000 per year at age 45 instead, assuming the same interest rate, you would have about $205,000 at age 65.

While the total contributions between the two vary only by $100,000, the total difference at age 65 is almost $800,000! That is the power of compound interest.

In answering the question of whether to invest or pay off debt, here are the best steps to take to set yourself up for the greatest financial outcome:

Build an Adequate Emergency Fund

While this does not exactly fall in the category of investing or paying off debt, saving up an adequate emergency fund is a crucial part of the process, and can save you from major setbacks as you work to achieve your goals.

An emergency fund is a pool of cash or cash equivalents set aside to protect you from unforeseen financial events that arise. This could be a loss of income or unexpected expenses like home or car repairs.

When you have a pool of money to draw from specifically designated for “rainy days,” you can avoid the potentially costly mistake of drawing from your retirement savings or taking on additional debt to cover the expenses. Additionally, an emergency fund can alleviate financial stress by giving you peace of mind that you won’t be taken off guard by an unexpected financial event. To me, that alone make an emergency fund worth having!

As a rule of thumb, an adequate emergency fund is considered as 3-6 months of non-discretionary (necessary) expenses:

- 3 months if there are two household incomes or a second source of income

- 6 months if you are single or if married and only one spouse works

Great work! Now that you have insured yourself with an adequate emergency fund, you can turn to the next stage in the process.

Maximize Your Employer 401(k) Match

If your employer offers a 401(k) with a matching contribution, and most do, this is priority #1 in your investing journey. Make sure you take advantage of this – it is free money!

Keep in mind, there may be a “vesting schedule” which tells you how long you need to stay at the company to keep all the employer matching contributions. The contributions you make will always be 100% yours to keep, regardless of how long you stay at the company.

Contribute the amount needed to get the full match, and let the power of compounding work for you!

Pay Off High Interest Rate Debt First

When you hold higher interest rate debt, such as balances on your credit cards, personal loans, or private student loans, these are the first debts that should be paid off. For most people, high interest is considered any debt that has an interest rate of 6% or more.[2]

It is generally advised to work to pay off these debts prior to focusing more heavily on investing. Credit cards often have interest rates between 15% and 30%[3], and it is very unlikely that you will be able to compound your investments at those interest rates over the long-term.

As you work to pay off these debts quickly, it would be smart to make more than your credit card’s minimum payment. Using the snowball technique or debt avalanche repayment method can help you build momentum and minimize the time it takes to pay off the debt.

Max out your Health Savings Account (HSA)

Once you have paid off your high interest rate debt, an HSA is a great tool to use to build your wealth and take advantage of tax benefits. Although there are some requirements that must be met in order to contribute to an HSA, if you are able to contribute to one, it is a great option.

An HSA is a savings account that can be used to pay for qualified medical expenses. The account can be invested to maximize growth potential over time. The best part though, is that if used correctly, it completely avoids taxation. You can think of it as a “triple tax savings:”

- First, when you earn income and contribute it to your HSA, you can deduct that income and not pay any taxes on it.

- Second, when you invest the money within the HSA and it grows and earns income, those earnings are also excluded from income for tax purposes.

- Third, when you withdraw funds from the HSA and use them to pay for qualified medical expenses, no taxes are due.

We all have medical expenses throughout our lives, and generally they increase as we age. On average, a retired couple age 65 may incur $315,000 in out-of-pocket medical expenses.[4] A well invested HSA can be a great way to capture tax-free growth and can significantly offset the higher healthcare costs incurred in retirement.

Max out your IRA

Once you have maxed out your HSA, a logical next step would be to contribute to an Individual Retirement Account (IRA). Indicated by the name, these tax-advantaged accounts allow you to set aside money for retirement. There are two types, traditional IRAs and Roth IRAs.

Traditional IRAs allow you to contribute pre-tax money, meaning that you can deduct the amount contributed from your current year’s income for taxes. The earnings in the account grow tax-deferred, so you don’t need to pay any tax until you withdraw the funds in retirement.

With a Roth IRA, you contribute after-tax money, which is income you can’t deduct from your current year’s income for taxes, but what’s cool about a Roth IRA is that you won’t pay income on the earnings, even when you withdraw the funds in retirement! Done right, Roth IRA withdrawals are completely tax-free!

When deciding between the two types, it often comes down to taxes, and whether it would be better to pay the taxes now, or defer them until retirement. If you expect your tax rate to be lower in retirement than your current tax rate, contributing to a traditional IRA may be a good option. If the opposite is true, a Roth IRA may be a better account for you.

IRAs can be an excellent investment vehicle in planning for retirement, and you can invest in mostly anything with an IRA.

Max out your 401(k)

After taking advantage of the full employer match in your 401(k) plan, contributing additional funds up to the contribution limit can be a great way to boost retirement savings.

For tax purposes, 401(k) plans are very similar to IRAs in that they allow for tax-deferred growth, but the annual limits are much higher, especially if you are 50 years or older.

If your employer offers a Roth 401(k) plan, this could be a great option as well. A 401(k) varies from a Roth 401(k) in a similar way as a traditional IRA varies from a Roth IRA.

If you have maxed out your IRA, and still have more money available to save, maxing out your 401(k) is a great option.

Pay off low interest rate debt

So, if you have reached this point and still have additional income to spare, you may want to consider paying off low interest rate debt. As a general rule of thumb, this would be debt with an interest rate of 6% or less.

Although the interest rate you are paying may be lower than the rate you could likely achieve if the funds are invested, paying down your debts will not only reduce your risk, but can increase your cash flow over the long term. Additionally, it can give you peace of mind once the debts are repaid.

Fund Taxable Investment Accounts

Once you have exhausted your options for tax-advantaged accounts, investing money in a standard brokerage account can help further boost your savings.

Although there are no special tax breaks that you receive with these accounts, it is nonetheless very beneficial to have additional investments that can grow over the long run and combat inflation instead of just saving the money in cash or a savings account.

Conclusion

The question of whether to invest or pay off debt is a puzzling problem but often overthought. Fortunately, the framework outlined here can be used as a helpful tool for your decision making. Use this list as guide, and you will be well on your way to achieving long-term financial success in retirement!

References

- “Debt in America: Statistics and Demographics.” Debt.Org, 4 Dec. 2023, www.debt.org/faqs/americans-in-debt/demographics/.

- Viewpoints, Fidelity. “Pay down Debt vs. Invest: How to Choose.” Fidelity, 21 Sept. 2023, www.fidelity.com/learning-center/personal-finance/pay-down-debt-vs-invest.

- Articles, Equifax, “How to Manage and Pay Off High-Interest Debt.” Equifax, www.equifax.com/personal/education/debt-management/articles/-/learn/manage-high-interest-rate/#:~:text=of%20secured%20debt.-,Credit%20cards%2C%20personal%20loans%20and%20private%20student%20loans%20tend%20to,between%2015%25%20and%2030%25. Accessed 18 June 2024.

- Viewpoints, Fidelity. “How to Plan for Rising Health Care Costs.” Fidelity, 21 June 2023, www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs.